Artificial Intelligence

How Businesses Win As AI Bubble Matures

January 1, 2026

Article

CK Editorial Team

6

min read

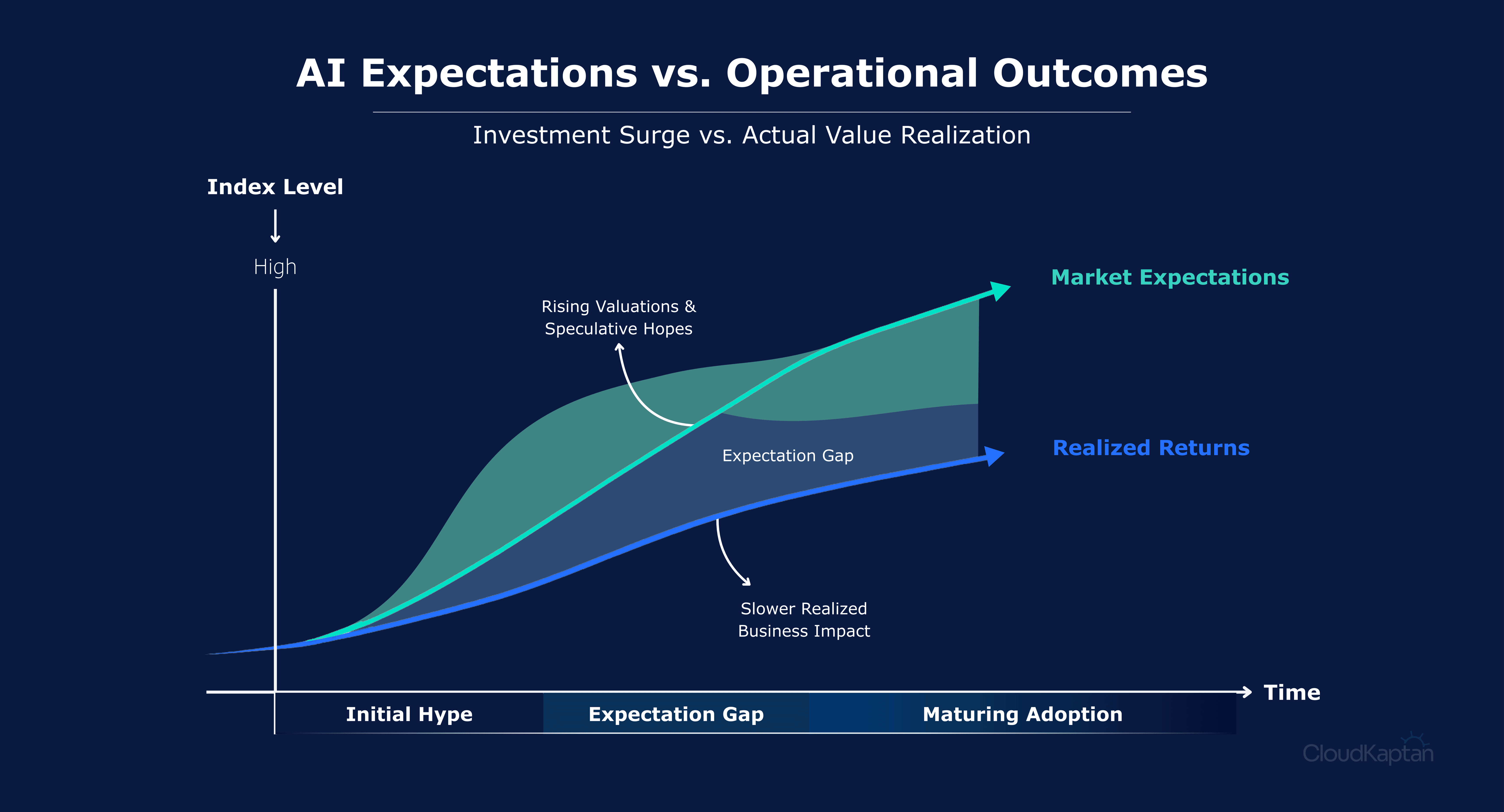

Across markets, leaders are hearing two contradictory messages at once: the AI ecosystem is booming, yet outcomes lag behind expectations. Venture capital funding in AI is poised to surpass hundreds of billions worldwide, and major global tech players keep investing heavily in infrastructure and innovation. Meanwhile, only a minority of organizations can point to clear, profitable returns from these investments, despite widespread enterprise adoption of AI across business functions.

Still, the core reality is that AI continues to reshape how businesses operate. Even if current enthusiasm proves excessive, the underlying shift toward AI-enabled workflows is already underway. As with post dot-com digitalization, market corrections may recalibrate expectations without reversing adoption, reflecting the continued expansion of AI use across industries and regions. In this context, continued investment reflects a practical response to structural change, with long-term relevance determined less by market sentiment and more by how effectively AI is implemented within business processes.

Why AI Investment Still Commands Business Attention

AI investment continues to attract sustained attention despite growing market uncertainty. Nearly 9 out of 10 companies report regular AI use in at least one business function.

What distinguishes lasting impact from temporary momentum is execution. While many firms are still scaling pilots, others are already reporting operational benefits, nearly half of organisations using AI in service operations cite cost savings, and a majority report revenue gains in sales and marketing functions.

As AI moves deeper into enterprise environments, durable value depends on how effectively it is embedded into everyday operations. Real implementation requires transformation in process and managing risks like:-

Security

Compliance and

Talent

All these factors increasingly determin whether AI investments translate into lasting business outcomes or remain isolated initiatives with limited operational impact.

Understanding the AI Bubble Narrative

Discussion around an AI bubble has intensified as investment levels rise faster than measurable returns. The focus has been less on whether AI creates value and more on the widening gap between capital inflows and operational outcomes.

AI’s potential is real and permanent, but returns are uneven and uncertain with most organizations struggling to move beyond pilots and capture meaningful value at scale. This imbalance has created room for contrasting interpretations of the current market.

Inflated expectations and speculative behavior → Analysts point to rising valuations and optimistic revenue assumptions that are not yet supported by consistent enterprise-level returns.

Persistent operational adoption → At the same time, AI continues to embed itself into workflows and business functions, making its presence difficult to reverse even if market sentiment or funding cycles change.

In this context, the real question for business leaders is not whether AI is a bubble, but how to navigate uncertainty while capturing long-term value. The focus shifts from predicting market cycles to building strategies that remain effective across them.

How Companies Make AI Work Beyond the Bubble

As market narratives fluctuate, the challenge for companies shifts from interpretation to execution. Making AI work beyond the bubble requires moving past experimentation and aligning investment with durable business outcomes.

Two priorities consistently emerge.

Build resilience → Organisations need operating models that can absorb uncertainty, adapt to cost pressures, and continue delivering value even as market conditions change.

Implement AI that creates value → AI must be tied to specific business problems, measurable outcomes, and workflows where its impact compounds over time.

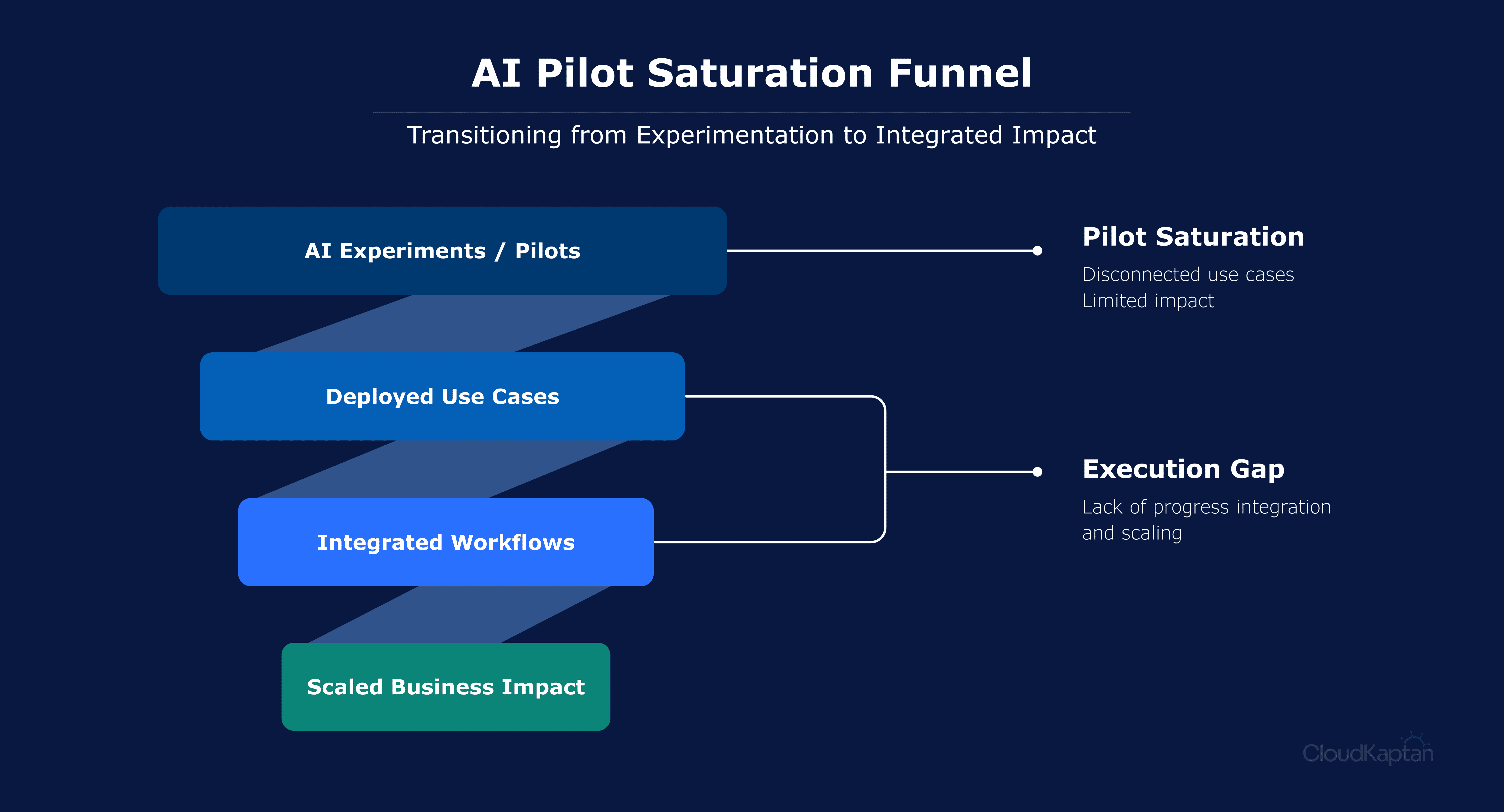

Many companies have experimented with AI through isolated pilots. While these initiatives demonstrate technical feasibility, they often fail to translate into operational impact.

Pilot saturation → Disconnected use cases increase complexity without improving performance.

Execution gap → Without process integration, governance, and ownership, AI remains peripheral rather than transformative.

Companies that move beyond the bubble focus less on expanding the number of AI initiatives and more on embedding a few high-impact applications into core operations. This requires identifying specific business problems, aligning them to measurable outcomes, and integrating AI into workflows so that results compound over time.

Navigating the AI Opportunity

Periods of rapid technological change are rarely linear. As with the dot-com era, phases of exuberance are often followed by recalibration. What matters is not whether a bubble forms, but what remains when expectations adjust. The core reality is that AI continues to reshape how businesses operate. Even if current valuations prove excessive and investment cycles turn, AI does not become irrelevant. The technology is already embedded in workflows, decision-making, and operating models.

The real question for business leaders is not whether AI is a bubble, but how to navigate uncertainty while capturing long-term value. That outcome depends less on market timing and more on execution through volatility. Making AI work beyond the bubble requires two priorities. Organisations must build resilience to absorb shifts in cost, regulation, and sentiment. And they must implement AI that creates value through process transformation and disciplined management of risks such as security, compliance, and talent.

In this phase of the AI cycle, relevance will belong to those who execute.